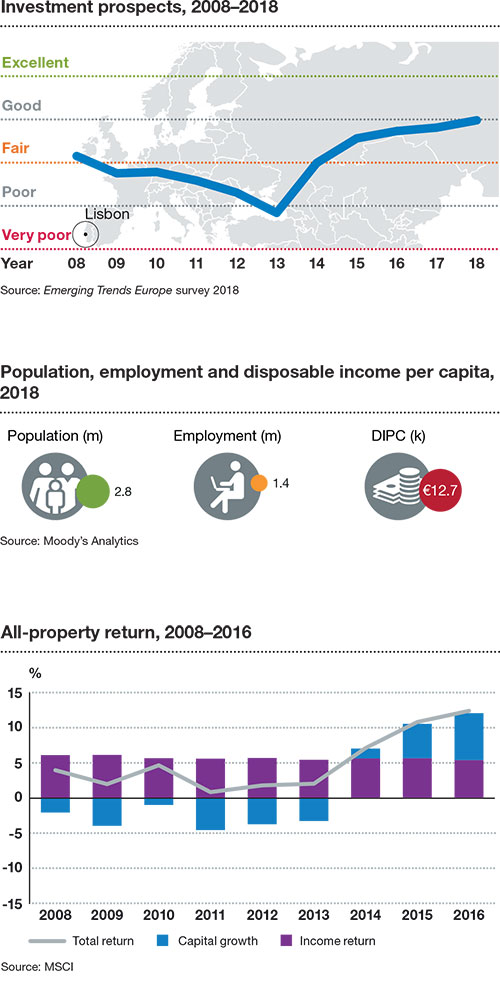

Portugal’s capital is a city to watch. For every pan-European respondent who says the market is too small and too illiquid, there is another who is either already investing or, more likely, sizing up the opportunities. Some of this is about willingness to take a bit more risk to widen the playing field, and those deciding to go ahead include core/core-plus investors, not just private equity funds finding fewer deals in bigger cities as the real estate cycle matures.

Portugal’s capital is a city to watch. For every pan-European respondent who says the market is too small and too illiquid, there is another who is either already investing or, more likely, sizing up the opportunities. Some of this is about willingness to take a bit more risk to widen the playing field, and those deciding to go ahead include core/core-plus investors, not just private equity funds finding fewer deals in bigger cities as the real estate cycle matures.

“Portugal is a relatively small country with question marks about liquidity. However, we are looking at a few things because there is a lot more activity than there was, say two or three years ago. It is a market that we would consider,” says a large pan-European investment manager. “We are expanding the number of cities we will consider to include Lisbon. This is to widen our opportunities as we expect to have a larger amount of equity to invest in our latest vehicle,” says the manager of a pan-European fund series.

In common with cities as different as Helsinki and Athens, Lisbon is one of the handful of office and retail markets offering the prospect of significant yield compression. Buyers can acquire fully-let, office buildings at 7 percent yields, and the EXPO Parque das Naçoes and waterside Santos Design districts are attracting investors. The country’s robust economic growth under a minority socialist government pursuing anti-austerity policies has been one of the positive surprises of the last two years. “Portugal’s economic story is pretty good, maybe not as compelling as Spain but positive,” considers one opportunistic player. “Lisbon and Porto benefit from some of the same things as Barcelona, like good weather, cheaper labour and good English and language skills.

This makes the capital attractive for back office functions, and the Lisbon office market is very dynamic.” Nascent niche sectors like student accommodation are generating interest, and one German-based sector specialist has a 250-bed scheme in the works and a second on the way in the capital. Another fund manager says: “We’re looking at retail in Portugal as well as Spain to see if we can find a well-located centre that needs some work. Investors are hunting value.” There could, however, be an amber light flashing over Lisbon’s downtown residential market which may be overheating, fuelled by Chinese and French investors lured by generous tax incentives and “golden visas”. “The prices are way higher than most Portuguese can afford,” says an opportunistic investor. “So as people are pushed out of the centre and want to buy houses again, that could present an opportunity to develop in other areas of Lisbon.”